Halfway between Stockholm and Göteborg lies Linköping. According to Tomasz it’s the fifth largest city in Sweden, which you wouldn’t think driving into it. I’d met up with him for a weekend of getting together – we don’t see each other as often as I’d like – and I like the adult feeling of checking in to a hotel, driving myself somewhere, etc. The sucky part of adulting is that you end up paying for the hotel, the petrol, the food and the beer. Which became a recurring conversation we had, what’s a sum of money we’d call “being rich” and how can we go about reaching it.

These days most people with an apartment are milionaires here in Sweden. They don’t have the money mind, but they can borrow against their house and so drive themselves further into dept hoping that the housing balloon won’t pop while they’re tethered to it. But we were talking of becoming rich for reals – i.e. having proper money in the bank – and doing it legaly. (no smuggling, murder or robbery).

Scalping is one way forward. Not illegal per se but the hallmark of a douchbag. It’s not that I necessarity want to add value to whatever process I’m using to get rich – but there feels like there’s a difference between “buy low sell hi” and “corner the market of whatever the kids want for Christmas.”

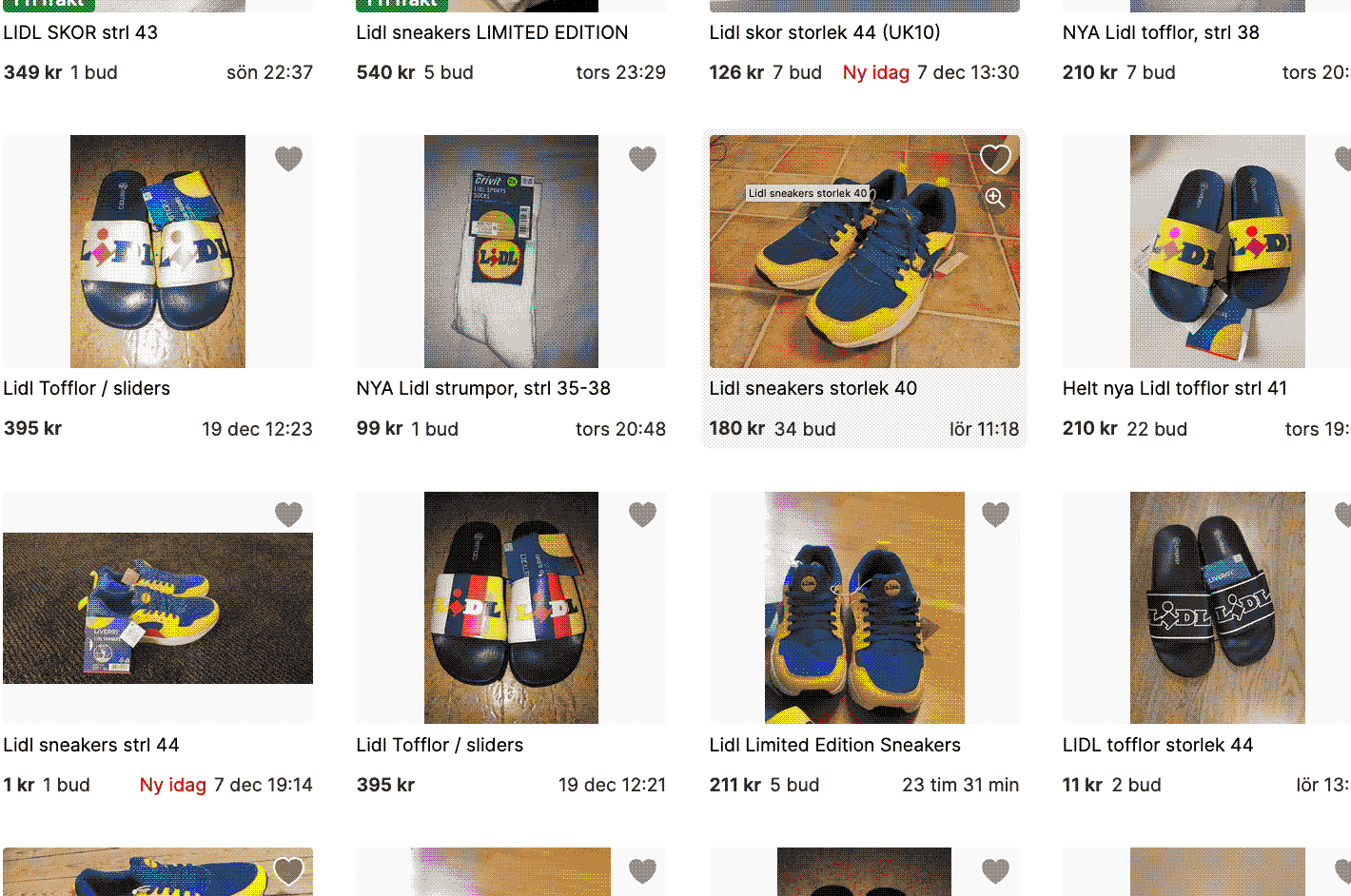

I make no illusions regarding my ability to spot an upcoming trend and investing in time. Just because something feels like an original idea to me doesn’t mean that others haven’t tried it out – only that I haven’t. An example of many people feeling clever might be the rush for limited edition Lidl sneakers which were available only for a day or so. You were only allowed to buy three pairs and according to Göteborgsposten people were behaving poorly in order to secure theirs. I don’t believe that everyone is intending to wear the shoes, but rather sell them on – as maybe evidenced by the many listings on auction site Tradera. Some of the prices were rather optimistic – the store price was 149kr and the “buy-now” price was set to more than ten times the amount.

So unless I stumble upon a really lucrative deal, or want to earn money by doing penny auctions for stock inventory, I need to come up with something else.

Occasionally when I’m on town this image pops into my head, of streams and rivers and trickles of richness moving through the air. Like a gold-rush fever dream I imagine that one ought to be able to just dip the pan into one of those streams and siphon off a percentage. Mind, I can’t tell you the shape of the flow, or what it is made of – I just know that it’s in reach but out of sight.

One avenue to riches which is well travelled in both directions – the direction towards being the hopeful one, the destitute return journey the other – is investment and speculation in stocks and other markets. I have nothing but contempt for the phenomena of day/swing trading, and being able to short stuff is of no value to the world, but it’s a legal way of trying to make money.

Might the stock market be worthwhile as a limited attempt at making money? I don’t have the time nor temper nor budget for daytrading, but in addition to doing some fundamental analysis and going long on some stocks (that’s fancy talk of buying stocks in companies and then keeping the stocks for the long haul) I’ll set aside a small amount and try my hand at swing trading – the goofy cousin of daytrading. When you’re into swing trading you’re doing something called “technical analysis” as opposed to fundamental ditto; you’re trying to discern patterns in how stocks fluctuate in value, and make money of your predictions.

Thing is, it basically reads like numerology. The author of the “for dummies” book on the subject lists patterns such as “head and shoulders” and “cup and handle” and then finds patterns where his models seem to predict something. But those stocks and patterns are picked after the fact. Just like in a gold rush where the real money is in selling shovels, I imagine that the real money swingtrading is made i writing books and consulting – not the actual trading.

There are some academic studies which find that some swing trading techniques can work some of the time in some markets – now I just have to read up a bit more on the subject, as well as fundamental analysis, and then dip a toe in the stream and see if it glimmers once I pull it out or if a gator will bite it off.